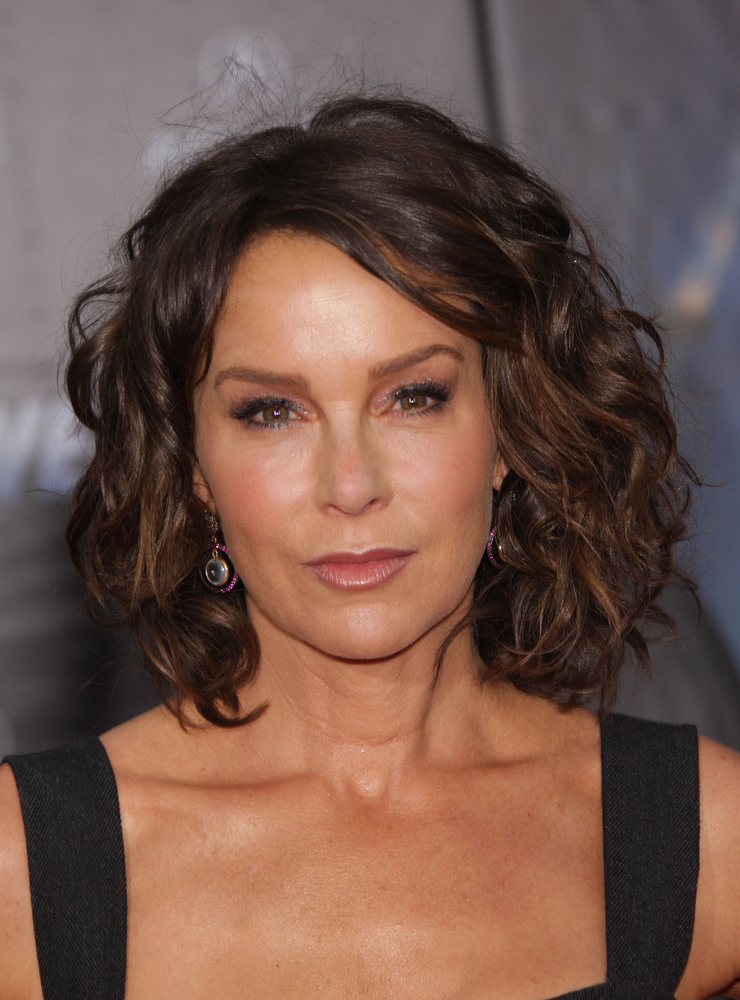

The actress who played “Baby” in the beloved movie Dirty Dancing, Jennifer Grey, was expected to see a significant boost in her career possibilities.

That was not to be, though. Instead, a terrible accident changed everything and forced her to give up the movie industry forever.

The terrible period in her life that left Jennifer Grey severely traumatized was finally discussed by the sixty-two-year-old Jennifer Grey after many years.

It’s a low-budget movie without a big name director or celebrity cast.

But when Dirty Dancing opened in theaters in August 1987, the actors and producers realized they had accomplished something truly great.

The primary actor, Patrick Swayze, achieved quick success. He became well-known as a sex icon and teenage hero before going on to appear in big-budget films like Donnie Darko and Ghost.

But when the movie first came out, his co-star Jennifer Grey wasn’t feeling well, so she swiftly disappeared from sight. Jennifer Grey disappeared amidst the chaos and celebrations just as quickly as she had appeared.

In addition, the actress spent a considerable amount of time away from the spotlight.

Nonetheless, in a recent interview with People Magazine, she revealed every detail of the accident that changed her life.

First, let’s take a look at Jennifer Grey’s life leading up to the tragic event that happened in the summer of 1987.

Jennifer Gray began taking dancing classes at a young age. Her father most likely urged her to seek a career in entertainment when she was born in New York in 1960. Her father, Joel Gray, was an actor, director, photographer, dancer, and vocalist.

Jennifer attended the Dalton School to study dancing and acting. After graduation in 1978, she began seeking acting roles, and she went on to study at the Neighborhood Playhouse School of the Theater. But it wasn’t a rose-colored dance in her life. Jennifer had to work as a waitress to pay the bills.

She did, however, manage to get a couple of TV commercials, including one for Dr. Pepper. Her first motion picture role was in 1984’s “Reckless.” A few years later, she had an incredible breakout role in “Dirty Dancing,” where she played Frances “Baby” Houseman.

The cherished film’s narrative is based on scriptwriter Eleanor Bergstein’s early years. Jennifer became well-known overnight and received a Golden Globe nomination for Best Actress.

Sad event

Unfortunately, she was never able to enjoy the enormous success.

Just before the movie’s August 1987 premiere, Grey and her then-boyfriend Matthew Broderick were residing in Ireland.

But Broderick was driving on the wrong side of the road when he struck another car, and the pair was involved in a horrifying auto accident. A woman and her daughter were killed instantly when they were in the other car.

Eventually, Broderick’s charges of careless driving were withdrawn. In contrast, Jennifer Grey only suffered minor bumps and bruises, but her psychological scars remained.

A few days later, Dirty Dancing had its premiere. Nevertheless, Grey was unable to enjoy the success of the film.

In the middle of such severe sadness and survivor’s guilt, it just didn’t feel right to be heralded as the next big thing. “It didn’t feel good to be the toast of the town,” Grey reportedly said, according to the Daily Mirror.

The actress’s anguish from the accident will never fully go away.

“My ambition and my head were never the same,” she told People.

The most awful nose job ever

Her struggle with survivor’s guilt caused her to disappear for a while in the early 1990s, but she reappeared in a single Friends episode in 1995.

By then, she had undergone plastic surgery, and her face was radically altered.

“I entered the operating room as a celebrity and left anonymous,” she said in 2012.

It was like being undercover or covered by witness protection. The worst nose job I’ve ever seen. I’ll always be this once-famous actress that nobody knows about because of a nose job.

Jennifer’s Hollywood career was sporadic after that.

By 2010, Jennifer had made a successful comeback to the mainstream media. She was a hit with the public once more after winning “Dancing with the Stars.” She said that was something that was important to her.

I feel like I’ve starved myself out of concern for what people may think of me. “This is like having a delicious steak after 23 years on a diet,” the actor said to People.

In 2018, Grey took another step toward the limelight she had previously left behind. She is expected to star in the upcoming motion picture Untogether and comedy Red Oaks.

Jennifer, we’re so happy to see you back to your passionate, happy self!

Who else has a strong need to go back in time to 1987 at this point? Watch the classic scene from Dirty Dancing down below. What beautiful memories!

Please share this news with your friends on Facebook. Like me, they probably watched Dirty Dancing and wondered what happened to the gorgeous Jennifer Grey!

How to Own Your Dream Home

For most people, their first home isn’t their dream home. It starts off nice enough. But as time goes by and your family grows, starter homes tend to get a little . . . cramped.

But don’t hate on your current home too much. Because while it gave you a safe and dry place to lay your head at night, it was also setting you up to own your dream home someday.

We’ll show you how it all works and walk you through the steps that’ll get you in your dream home—one you can actually afford!

How to Get Your Dream Home in 5 Steps

Here are the steps:

- Follow the Financial Basics

- Find Out How Much Equity You Have

- Set Your New Home-Buying Budget

- Find the Right Dream Home for You

- Be Picky and Patient

Now let’s cover each step in more detail.

Step 1: Follow the Financial Basics

First thing’s first—you have to get out of debt, get on a budget, and build up an emergency fund of 3–6 months of expenses. Sounds pretty basic, right? If you haven’t completed these steps, then you’re not ready to upgrade to your dream home . . . yet.

Now, when you’ve got house fever, it can be hard to focus on paying off debt or saving an emergency fund before you upgrade your home—especially when you’re feeling the pressure of rising home prices and interest rates.

But whether it’s your second or third house, you should only buy a home when you’ve covered the financial basics we mentioned above. Then you’ll be ready to start the journey toward owning your dream house.

And that journey starts with your home equity. What’s equity? Well, we’re glad you asked . . . that brings us to the next step.

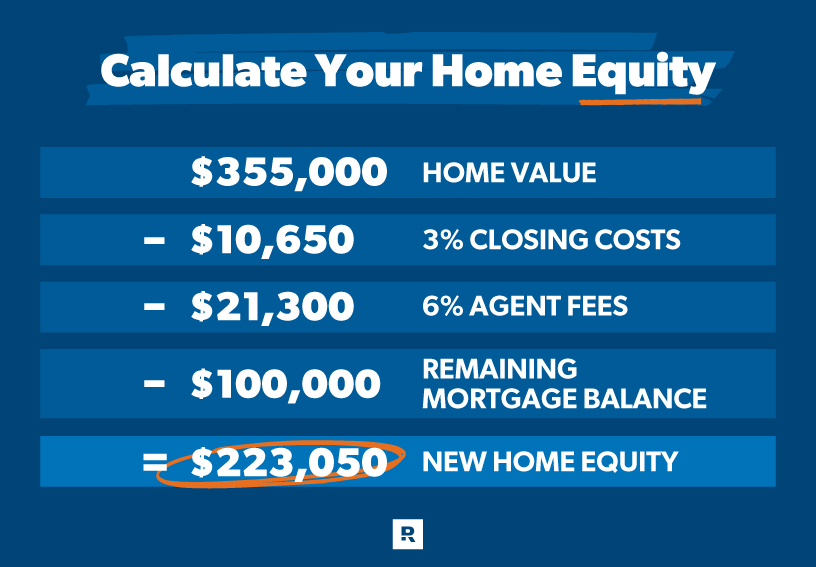

Step 2: Find Out How Much Equity You Have

Home equity is a pretty simple concept: It’s your current home’s value minus whatever you still owe on your mortgage.

See, in most cases, your home’s value increases over time. Similar to other long-term investments (like retirement accounts), homes gradually increase in value. There have been periods of ups and downs in the market to be sure, but the value of real estate has consistently gone up. According to the St. Louis Federal Reserve, the average sale price of a home has increased over 2,300% from 1965 to 2023! And in the last ten years (2013 to 2023), there’s been a 68% increase.1 As your home increases in value, so does your equity. In real estate terms, this is called appreciation.

Other factors that increase your home’s equity include:

- Added value: Home improvement projects like adding square footage, updating fixtures and appliances, or even just slapping on a new coat of paint can add value to your home.

- Mortgage paydown: Paying down your mortgage not only gets you out of debt faster, it also builds your equity. The less you owe on your home, the more equity you have.

The amount of equity you have gives you a pretty good idea of how much money you’ll end up with after selling your house. You can use that money to make a hefty down payment and cover the other costs that come with buying a home.![]()

Find expert agents to help you buy your home.

So, how do you determine your home’s value? Well, you can get a ballpark estimate on real estate websites like Zillow, ask a trusted real estate agent to perform a competitive market analysis (which they’ll do anyway if they’re helping you sell your house), or get a professional appraisal.

Finding out your home’s equity will involve a little math, but it’s third-grade-level stuff, so don’t sweat it.

Here’s what we mean. Let’s say your home’s current value is $355,000. When you sell that house, you’ll have to pay for between 1–3% of the sale price in closing costs, another 6% in fees for the real estate agent who helped you sell it, and whatever’s left to pay off on your mortgage.

That means you can estimate clearing over $223,000 from selling your house. That’s a killer down payment on your dream home! And if your home is paid off, that’s even more money to put down and use to pay for things like repairs and moving expenses.

Step 3: Set Your Dream Home Budget

Once you know how much you’ll clear from the sale of your home, you can start making a budget for your dream home.

The key to owning your dream home (instead of it owning you) is to keep your mortgage payment to no more than 25% of your take-home pay on a 15-year fixed-rate mortgage, along with paying a down payment of at least 20% to avoid private mortgage insurance (PMI). Never get a 30-year mortgage even if the bank offers it (and they will). You’d pay a fortune in interest—money that should go toward building your wealth, not the bank’s.

So, let’s say your take-home pay is $4,800 a month. That means your monthly mortgage payment shouldn’t be any bigger than $1,200. By the way, that 25% figure should also include other home fees collected every month with the mortgage payment like homeowners association (HOA) fees, insurance premiums and property taxes.

Plug your numbers into our mortgage calculator to see how much house you can afford.

And don’t forget to budget for all those other costs that come with the home-buying process in addition to your closing fees—things like moving expenses and any upgrades or repairs you might need to make. You don’t want these hidden costs to catch you off guard or drain your emergency fund.

Step 4: Find the Right Dream Home for You

This is where things get real. After all your hard work building up your equity (and doing a lot of math—don’t forget that), you’re finally ready to start the house hunt. Woo-hoo!

But don’t lose focus. Stay zoned in by making a list of features that make a home fit your budget, lifestyle and dreams—and stick to it throughout your house hunt. Here are a few ideas to get you started.

- Don’t compromise on location and layout. If you plan to be in this home for the long haul, an out-of-the-way neighborhood or a wacky floor plan is a deal breaker. Look for a community and layout that’ll suit your lifestyle now and for years to come.

- Think about how much space your family needs. While your budget has the final say about how much home you buy, you’ll want your dream home to fit your family’s needs through different life seasons.

- Consider the school districts. If you have or want kids, the quality of the nearby school districts is probably already on your mind. But even if you don’t have kids or you’re retired, keep in mind that having good schools nearby could increase your home’s value.

- Look for a house that’ll grow in value. Are home values rising in the area? Is the number of businesses going up? These factors can help you figure out whether your dream home will turn into a good investment.

- Count the costs. Want that fancy master bathroom with the multiple showerheads and the Jacuzzi tub? Be clear on what’s a must-have and what’s nice to have. And don’t forget, upgraded features like that will make your dream home more expensive.

Step 5: Be Picky and Patient

We know you’re anxious to get into those new digs, but be patient. Wait for the right house at the right time. Don’t spend your money on a less-than-ideal home just because you’re tired of looking.

The key is finding a good real estate agent who understands your budget and refuses to settle for “good enough.” They’re as committed to your dream as you are and will have your back throughout the entire process, no matter what it takes.

In addition to teaming up with a great real estate agent, you can take a couple of extra steps to make sure you’re ready to strike as soon as the right home comes up:

- Get preapproved for a 15-year fixed-rate mortgage. Having preapproved financing is a green flag for sellers—especially in multiple offer situations. And because this puts most of your information in the lender’s system, you’ll be on the fast track to closing once your offer is accepted.

- Offer earnest money with your bid. Earnest money is a deposit to show you’re truly interested in a home. Usually it’s 1–2% of the home’s purchase price and it’s applied to your down payment or closing costs. Even if the deal falls through, you can almost always get most of it back.

Find a Real Estate Expert in Your Local Market

Now, you might be thinking you have some work to do before you’re ready to find your dream home. Or you may be realizing your years of hard work are about to pay off! Regardless, if you follow these steps, you’ll find the house you’ve always wanted and avoid a purchase you’ll regret.

Once you’re ready, connect with one of our RamseyTrusted real estate agents. These are high-performing agents who do business the Ramsey way and share your values so you can rest easy knowing the search for your dream home is in the right hands.

Find the only real estate agents in your area we trust, and start the hunt for your dream home!

Leave a Reply