For most people, their first home isn’t their dream home. It starts off nice enough. But as time goes by and your family grows, starter homes tend to get a little . . . cramped.

But don’t hate on your current home too much. Because while it gave you a safe and dry place to lay your head at night, it was also setting you up to own your dream home someday.

We’ll show you how it all works and walk you through the steps that’ll get you in your dream home—one you can actually afford!

How to Get Your Dream Home in 5 Steps

Here are the steps:

- Follow the Financial Basics

- Find Out How Much Equity You Have

- Set Your New Home-Buying Budget

- Find the Right Dream Home for You

- Be Picky and Patient

Now let’s cover each step in more detail.

Step 1: Follow the Financial Basics

First thing’s first—you have to get out of debt, get on a budget, and build up an emergency fund of 3–6 months of expenses. Sounds pretty basic, right? If you haven’t completed these steps, then you’re not ready to upgrade to your dream home . . . yet.

Now, when you’ve got house fever, it can be hard to focus on paying off debt or saving an emergency fund before you upgrade your home—especially when you’re feeling the pressure of rising home prices and interest rates.

But whether it’s your second or third house, you should only buy a home when you’ve covered the financial basics we mentioned above. Then you’ll be ready to start the journey toward owning your dream house.

And that journey starts with your home equity. What’s equity? Well, we’re glad you asked . . . that brings us to the next step.

Step 2: Find Out How Much Equity You Have

Home equity is a pretty simple concept: It’s your current home’s value minus whatever you still owe on your mortgage.

See, in most cases, your home’s value increases over time. Similar to other long-term investments (like retirement accounts), homes gradually increase in value. There have been periods of ups and downs in the market to be sure, but the value of real estate has consistently gone up. According to the St. Louis Federal Reserve, the average sale price of a home has increased over 2,300% from 1965 to 2023! And in the last ten years (2013 to 2023), there’s been a 68% increase.1 As your home increases in value, so does your equity. In real estate terms, this is called appreciation.

Other factors that increase your home’s equity include:

- Added value: Home improvement projects like adding square footage, updating fixtures and appliances, or even just slapping on a new coat of paint can add value to your home.

- Mortgage paydown: Paying down your mortgage not only gets you out of debt faster, it also builds your equity. The less you owe on your home, the more equity you have.

The amount of equity you have gives you a pretty good idea of how much money you’ll end up with after selling your house. You can use that money to make a hefty down payment and cover the other costs that come with buying a home.![]()

Find expert agents to help you buy your home.

So, how do you determine your home’s value? Well, you can get a ballpark estimate on real estate websites like Zillow, ask a trusted real estate agent to perform a competitive market analysis (which they’ll do anyway if they’re helping you sell your house), or get a professional appraisal.

Finding out your home’s equity will involve a little math, but it’s third-grade-level stuff, so don’t sweat it.

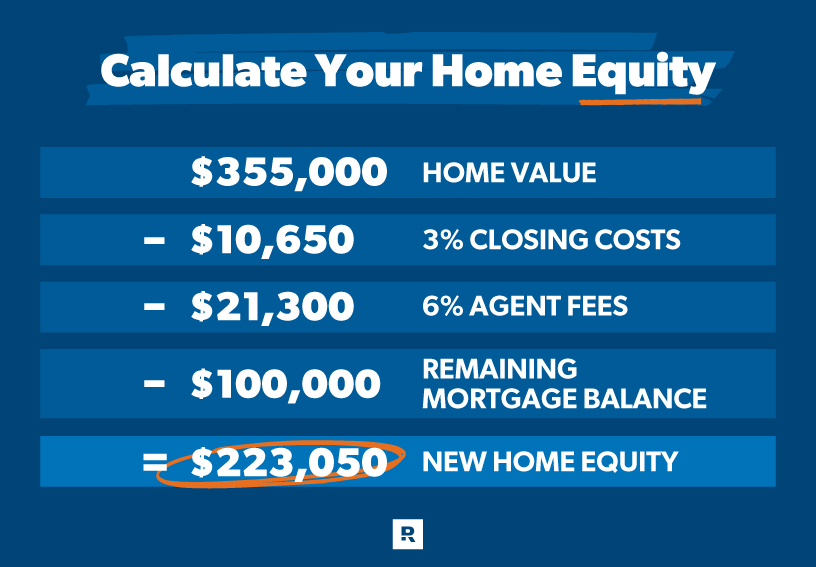

Here’s what we mean. Let’s say your home’s current value is $355,000. When you sell that house, you’ll have to pay for between 1–3% of the sale price in closing costs, another 6% in fees for the real estate agent who helped you sell it, and whatever’s left to pay off on your mortgage.

That means you can estimate clearing over $223,000 from selling your house. That’s a killer down payment on your dream home! And if your home is paid off, that’s even more money to put down and use to pay for things like repairs and moving expenses.

Step 3: Set Your Dream Home Budget

Once you know how much you’ll clear from the sale of your home, you can start making a budget for your dream home.

The key to owning your dream home (instead of it owning you) is to keep your mortgage payment to no more than 25% of your take-home pay on a 15-year fixed-rate mortgage, along with paying a down payment of at least 20% to avoid private mortgage insurance (PMI). Never get a 30-year mortgage even if the bank offers it (and they will). You’d pay a fortune in interest—money that should go toward building your wealth, not the bank’s.

So, let’s say your take-home pay is $4,800 a month. That means your monthly mortgage payment shouldn’t be any bigger than $1,200. By the way, that 25% figure should also include other home fees collected every month with the mortgage payment like homeowners association (HOA) fees, insurance premiums and property taxes.

Plug your numbers into our mortgage calculator to see how much house you can afford.

And don’t forget to budget for all those other costs that come with the home-buying process in addition to your closing fees—things like moving expenses and any upgrades or repairs you might need to make. You don’t want these hidden costs to catch you off guard or drain your emergency fund.

Step 4: Find the Right Dream Home for You

This is where things get real. After all your hard work building up your equity (and doing a lot of math—don’t forget that), you’re finally ready to start the house hunt. Woo-hoo!

But don’t lose focus. Stay zoned in by making a list of features that make a home fit your budget, lifestyle and dreams—and stick to it throughout your house hunt. Here are a few ideas to get you started.

- Don’t compromise on location and layout. If you plan to be in this home for the long haul, an out-of-the-way neighborhood or a wacky floor plan is a deal breaker. Look for a community and layout that’ll suit your lifestyle now and for years to come.

- Think about how much space your family needs. While your budget has the final say about how much home you buy, you’ll want your dream home to fit your family’s needs through different life seasons.

- Consider the school districts. If you have or want kids, the quality of the nearby school districts is probably already on your mind. But even if you don’t have kids or you’re retired, keep in mind that having good schools nearby could increase your home’s value.

- Look for a house that’ll grow in value. Are home values rising in the area? Is the number of businesses going up? These factors can help you figure out whether your dream home will turn into a good investment.

- Count the costs. Want that fancy master bathroom with the multiple showerheads and the Jacuzzi tub? Be clear on what’s a must-have and what’s nice to have. And don’t forget, upgraded features like that will make your dream home more expensive.

Step 5: Be Picky and Patient

We know you’re anxious to get into those new digs, but be patient. Wait for the right house at the right time. Don’t spend your money on a less-than-ideal home just because you’re tired of looking.

The key is finding a good real estate agent who understands your budget and refuses to settle for “good enough.” They’re as committed to your dream as you are and will have your back throughout the entire process, no matter what it takes.

In addition to teaming up with a great real estate agent, you can take a couple of extra steps to make sure you’re ready to strike as soon as the right home comes up:

- Get preapproved for a 15-year fixed-rate mortgage. Having preapproved financing is a green flag for sellers—especially in multiple offer situations. And because this puts most of your information in the lender’s system, you’ll be on the fast track to closing once your offer is accepted.

- Offer earnest money with your bid. Earnest money is a deposit to show you’re truly interested in a home. Usually it’s 1–2% of the home’s purchase price and it’s applied to your down payment or closing costs. Even if the deal falls through, you can almost always get most of it back.

Find a Real Estate Expert in Your Local Market

Now, you might be thinking you have some work to do before you’re ready to find your dream home. Or you may be realizing your years of hard work are about to pay off! Regardless, if you follow these steps, you’ll find the house you’ve always wanted and avoid a purchase you’ll regret.

Once you’re ready, connect with one of our RamseyTrusted real estate agents. These are high-performing agents who do business the Ramsey way and share your values so you can rest easy knowing the search for your dream home is in the right hands.

Find the only real estate agents in your area we trust, and start the hunt for your dream home!

‘I’m Waiting for Mom,’ Girl Says to Park Janitor, Next Day He Sees Her Still Sitting at Same Spot – Story of the Day

A park janitor meets a lonely little girl who says she is waiting for her mom. He is surprised when he sees her again the next day, still sitting on the same bench, and calls the police.

Albert Fairchild was the custodian of a lovely old Victorian park in the middle of the city, and his time was spent making sure it was a little corner of heaven, a place where lovers met, and people went to get in touch with nature or for a little peace of mind.

He loved his job. Every day he wandered through the park, raking the paths, emptying the bins, and making sure everything was perfect, and twice a week, the city gardeners came around to take care of the lawns, trees, and plants.

For illustration purposes only | Source: Unsplash

One afternoon, Albert saw a little girl sitting quietly at one of the park’s picnic tables, coloring in a picture book. She was surely no more than four or five, but she was all alone! Albert looked around, but he couldn’t see her parents. Something had to be wrong…

Albert approached the little girl and greeted her. “Hello there, little miss. What are you doing out here all on your own? Trying to catch the fairies?”

The little girl looked up at Albert. “You’re a stranger, and I’m not supposed to talk to strangers,” she said.

“No, you are not,” Albert agreed. “But you’ll see I’m not asking you to go anywhere with me, and I’m not offering you candy. I just want to know where your mom is and why you’re alone.”

“I’m waiting for mom,” the child said. “She had a job interview across the road, and she asked me to wait here for her. Mom said not to talk to strangers and not to go anywhere. I have my juice and a snack, and she will be back very soon!”

Nothing is impossible, so keep going until you accomplish what you want.

Albert frowned. It wasn’t exactly safe to leave a child in a public park, but he knew that sometimes single moms with no resources or family had to do the best they could — and it sounded as if this mom was unemployed and desperate to boot.

“What’s your name, little miss?” Albert asked.

The girl giggled. “My name is Margaret,” she said.

For illustration purposes only | Source: Pexels

“That’s a HUGE name!” exclaimed Albert. “It’s three times as big as you are!”

“My mom calls me Meg,” she confessed, laughing. “And I DON’T believe in fairies!”

Albert gasped and clutched at his heart. “I’m shocked, little miss Meg!” he laughed. “I believe in fairies. In fact, I see them all the time! I have to chase them away from the fountains ’cause they insist on taking showers and breaking the rainbows!”

Meg was grinning. “That’s a LIE!” she giggled. “That’s BAD!”

“Well,” Albert said. “I have a lot of work to do, but I’ll be keeping an eye on you, making sure the fairies don’t pull your pigtails. If you need me, Meg, just holler, and I’ll come running, OK?”

Albert walked away, but he kept glancing back over his shoulder. He wished he had a little person just like Meg in his life, a little granddaughter, but he knew it was not to be.

He could not help but pause his work and silently cry as the little girl reminded him of his own granddaughter and the fateful tragedy that toppled his life.

For illustration purposes only | Source: Pixabay

Five years ago, Albert was a cop who loved his duty more than anything else. At home, he was a loving and caring husband, a doting father, and an adorable grandfather. “But if it had not been for that day…” Albert reminisced about the fateful day.

It was a pleasant Sunday in May that year. Albert’s family was leaving on a much-awaited dream vacation by the sea in the neighboring city. He had taken a week off to enjoy himself with his family. Albert still remembered his granddaughter Emily running back inside to bring her teddy bear, Chelsea.

“How happy she was that morning!” he thought. Her laughter still haunted him because he never got to see her again. Albert wanted to drive and wouldn’t leave the driver’s seat even when his son-in-law, Josh, persuaded and pleaded.

“It’s your day, dad! I will drive. You need to rest and enjoy this trip,” he told Albert, who refused to get down from his minivan. Albert would’ve never moved out if it were not for a sudden call from the station.

“I’m on my way,” he spoke. “I got to go. I got an important lead for an investigation. You guys get going. I’ll catch up tomorrow evening!” he told his family. They were disappointed, especially little Emily. She wanted to sing songs and play with Albert.

“Sweetie, grandpa will be there tomorrow. It’s just a day!”

Albert and Emily blew endless flying kisses as the minivan sped past the gate. Albert left for work immediately, and it was almost time to return home in the evening when he got a call from the city station.

For illustration purposes only | Source: Unsplash

An hour later, he was taken to the morgue in the city hospital. His heart dropped when four stretchers were wheeled out, the last was Emily’s. His whole world was destroyed in a car crash.

“The minivan lost control and rammed into a truck,” officers told him, patting his shoulder. In a wink, Albert had lost his family, and there was no coming back. No more laughter. No more vacations. And no more loud cries of a little girl shouting, ‘Grandpa! I’m home!’

Albert could not forgive himself. “I should have driven that minivan. I shouldn’t have allowed Josh to drive it,” he thought and cried over a million times. But nothing was going to change.

“Jose, I should’ve canceled that trip. I should’ve never let them go,” he cried to his best friend at the funeral, placing Emily’s teddy bear, Chelsea, on her grave.

Days, months, and five years passed. These questions still haunted Albert, but it didn’t matter to him. He knew he had lost his family forever. They were not going to come back; it was the ugly truth he had learned to embrace over time.

Albert could not focus on his work. The cop job he loved became a constant reminder of his tragic life. He quit it and started taking care of the park. He just wanted to stay away from everything that reminded him of his loss.

A gush of wind snapped Albert to the present as he wiped away his tears. The evening sun irritated his teary eyes as he looked around for the little girl. “Where is she??” he exclaimed when he saw Meg was not in her place.

For illustration purposes only | Source: Pexels

Albert hastily looked around the park for the girl. But she was not there. “Maybe her mother took her,” he thought. Convinced Meg had gone home, Albert finished raking the lawn and went home.

But the following morning, when he returned to the park, he saw Meg again, sitting in the same spot, wearing the same dress, and holding her teddy. Albert was stunned.

“Hey, there, little miss!” he greeted the girl. “What are you doing here so early?”

“Mommy didn’t come,” she disappointedly said. “She never came for me.”

“What?? Where did you go last evening, then? And where did you sleep?”

“Home,” Meg replied, resting her teary face on her teddy. She refused to look up at Albert. She was least interested in talking to him and kept looking around to see if her mother had come to take her.

“What happened to her mother?” Albert wondered.

“Hey, there, I’m a former policeman. You can trust me, alright?” he said. “I’m afraid your mother got lost in this huge city. Can you take me to your home? We will find your mother, alright?”

But Meg wouldn’t move. Her strong belief her mother would come for her didn’t let her move from that bench.

For illustration purposes only | Source: Pixabay

“Meg, listen, I know you are frightened. But there’s nothing to be afraid of. You can trust me, okay? What’s your mother’s name?”

When Meg told Albert her mother’s name, she had difficulty pronouncing the surname. Albert asked Meg to repeat the word several times because he knew he could not search for her mother without knowing the surname. He needed her full name to probe everywhere, including online databases. After hearing Meg out repeatedly, Albert guessed her mom’s surname could be ‘D’Cruz.’

“Listen, we need to go to your home. Do you want to see your mother?”

“Yes, I want to see mommy,” Meg replied, finally looking at Albert.

“Then take me to your house.”

Moments later, Meg led Albert to a tarp tent under a secluded bridge not far from the park’s entrance. “This is my home,” she pointed.

Albert partially understood Meg and her mother were homeless. He inspected the tarp tent that barely had an old mattress and a camping stove with a pot smelling of stale porridge. There were a few old clothes of Meg’s in the tent, but no photos or pictures. At first glance, he thought Meg’s mother could’ve abandoned her. But something still didn’t add up to him.

“How long have you been living here?” he asked the girl.

“Few weeks,” replied Meg. “We once had a big house. But big, angry men in uniform shouted at my mommy for not giving money. Mommy cried, and even I cried. They threw our things out, and mommy brought me here.”

Albert once again checked the tent for clues but apparently found nothing that could help him find Meg’s mother. “Do you have your mother’s photo?”

“No, I had one, but it’s with mommy.”

For illustration purposes only | Source: Unsplash

Albert was puzzled about what to do next. “I cannot leave the girl alone here,” he thought, and before he could fathom anything, Meg asked him to take her back to the park.

“Mommy told me to wait there and not go anywhere. If she comes, she will scold me. Please take me to the park.”

Albert did not know what to do and agreed. Meg and he returned to the park, and he sat her down on the bench. Albert knew Meg would have starved the whole night, so he gave her his lunch.

“Mommy told me not to eat from strangers,” Meg refused, but her eyes and nose couldn’t deny the delicious aroma of the pie in Albert’s lunch box.

“Ummm, that tastes delicious. Sweet. Ummm,” Albert ate a spoonful in front of Meg. “If you don’t want it, I’ll eat it fully. I can finish the whole pie in two minutes. You sure you don’t want it?!”

Meg grabbed the lunchbox and started devouring the pie. Albert was pleased his trick worked and went on with his work while Meg waited for her mother.

Hours passed, and it was close to sundown, but her mom never came. Meg burst into tears, and Albert’s heart wouldn’t allow him to leave her alone again.

“Do you want to go home with me? We will come back tomorrow and wait for your mother, alright?” he asked Meg.

For illustration purposes only | Source: Pixabay

Meg agreed and went home with Albert. “Yeah, I only know her name is Margaret. But I don’t have a clue about her mother. Could you please let me know? She said her mom has blonde hair, is tall, age must be around 24 or 25, I guess,” Albert informed his former colleagues in the department.

Meg could not spell her mother’s name accurately and gave vague descriptions of her appearance. But Albert could not say anything for sure. He made out a name and a surname using Meg’s broken spellings but was unsure if it was correct.

“When will mommy come?” Meg asked Albert.

“She will come soon, sweetie. Now go to that room and change your dress. You’ll find a lot of clothes in the little cupboard. I’ll make dinner meanwhile.”

Meg returned minutes later wearing Emily’s pajamas. She ran around Albert as he whisked the eggs and giggled to an old song playing on the gramophone. For the first time in five years, Albert never felt lonely.

Albert was on the phone the whole night as Meg slept in Emily’s room. He wanted to find her mother at any cost and was busy working at it with his friends.

“No, pal,” an officer called him late at night. “We even checked reports of murders of young women with similar descriptions and surnames, but no lead. There were no instances reported recently.”

Albert sighed, assured Meg’s mother was alive somewhere. While putting out the lights in Emily’s room, he saw Meg curled up and fast asleep on her bed.

For illustration purposes only | Source: Pixabay

Albert was up until the wee hours, gathering contact details of hospitals in the city. He suddenly woke up when the morning rays irritated his sleepy eyes. He was exhausted and had slept off in his armchair.

“Oh my God, Meg??” he ran to check on her, thinking she would’ve gone to the park alone while he was dozing. “Jesus, thank goodness!” he sighed when he saw she was still fast asleep.

Albert then contacted every hospital in the city to find out about Meg’s mother. He even reached out to a friend in the morgue, but nothing helped. Nobody had heard about the woman with his description and surname.

Albert was puzzled about what to do next. “Cops will hardly try and carefully look for a homeless woman. And if I have to send her to a foster home, she’ll likely never see her mother again,” he thought. Then, Albert realized that the only reliable way to help Meg was to search for her mother on his own. It was not for nothing he was a cop for 30 years.

Albert brought Meg to the park every day and sat her in the exact spot her mother last left her. He asked his friends to watch over her while he searched for the missing woman. Albert knew he could not do all this while working, so he took a few days off.

For illustration purposes only | Source: Pexels

He first started visiting all the homeless shelters in the city and neighboring towns. “Her name is Candy D’Cruz… Do you know someone with that name?” he asked almost everyone he encountered.

He checked with all the offices that had a “We’re Hiring” sign to find out if Meg’s mother had, by chance, attended any interviews. He even checked in several refuges he knew of, but nothing turned up. Nobody had seen a woman with the name Candy D’Cruz.

Albert even searched on social media and showed Meg the photos of several women with similar names, but none of them was her mother. He checked every street and traffic camera near the park but could not find a clue.

A month passed, and Albert almost lost hope of finding Meg’s mother. All his attempts were fruitless. But Meg never gave up and refused to do anything other than visit the park daily, waiting for her mother from dawn to dusk.

“How will mommy find me if I’m not there,” she often argued with Albert. One morning, as they left for the park, it started raining.

“Sweetie, I’ll take you to the park tomorrow. You’ll catch a cold,” Albert told Meg, but she was stubborn.

“No, we’ll go and wait there. Mommy will come,” she said.

Albert could not convince her. They took a bus to the park as they could not walk in the rain. The route was longer and passed several stations. And while crossing one such station, Meg started shouting.

“There she is! There is mommy!”

Albert was startled. “Where??” he rose from his seat. He thought she’d confused somebody else for her mother but still asked the driver to stop the bus.

For illustration purposes only | Source: Unsplash

Albert quickly helped Meg out of the bus and hastily looked around at all the women he noticed. “Where is she??” he asked her.

Meg tugged his arm to a billboard on a sidewalk and pointed, shouting, “There…That’s my mommy!”

“Where? Which one??” Albert asked her.

“There…the second from the left…She’s my mommy…She’s my mommy!!”

The words on the billboard read: “Do You Know Me? Please Call On This Number” next to the name “Cadence Delacruz.” He gasped in shock after learning Meg’s mother’s name was Cadence, not Candy.

“What is written there?” Meg interrupted.

“It’s an advertisement for lost people,” he told her.

“What is that? What does it mean??”

“It means we are going to find your mother!!” Albert carried Meg cheerfully as he called the number on the billboard.

“City hospital,” the attendant answered. “Yes, she was admitted here.”

For illustration purposes only | Source: Getty Images

When they got to the hospital, they were told Meg’s mother had already left. “Mommy has gone? Where did she go?” Meg started to cry.

“Sweetie, hold on…One second,” Albert comforted her.

“How did she come here? What happened to her?” he asked the nurse.

“She was brought here with a severe head injury over a month ago. She’d suffered from a traumatic brain injury that caused amnesia,” the nurse said.

“Where is she? We want to see her,” Albert asked her.

“She needed expensive treatment. She was in a coma for a few weeks and could not recall anybody when she woke up. Nobody came to take her. We even advertised her name and picture, but nobody turned up. She was discharged last week and sent to a shelter for the homeless.”

Albert was afraid Meg would lose her mother again. He then rushed to the shelter with the girl.

For illustration purposes only | Source: Unsplash

Meg clutched Albert’s little finger as she looked around for her mother. Then she ran as fast as her little legs could carry her toward a bed in a corner.

“MOMMY!!” she cried and ran to her mother. “Mommy, where did you leave me and go?”

Cadence had a photo of them together and remembered Meg was her daughter as soon as she saw her and heard her call her mommy.

“I don’t know, sweetie,” she burst into tears.

Albert was speechless and moved at seeing Meg laughing and crying with her mother. “You need to come with me,” he interrupted.

“Where? And who are you?” Cadence asked.

“I’m Albert. I’m a janitor in the park. I found your daughter…” he paused. “I’ll explain everything later. You and Meg need to come home with me now.”

Albert took Cadence home and offered to stay in his house as long as she wanted. He spent all his savings on her treatment. It took several months before Cadence could recall some crucial moments of her life. Being around her daughter helped her to a great extent. Gradually, Cadence remembered everything, and Albert was curious to know how she had hurt herself.

For illustration purposes only | Source: Pexels

“My husband had mortgaged our house,” she recalled. “I was not able to pay the loan after he died in an accident. Our house was taken, and then I rented a small room with my daughter. I lost my job, and my landlord kicked us out for not paying rent.”

After she was stranded on the street, Cadence could not find a job almost immediately. She did not want her daughter to live in the shelter for the homeless, so they temporarily camped in the tarp tent under the bridge.

Albert felt sorry for Cadence and sighed with relief things ended well for her and Meg. “But how did you get hurt?” he asked her.

Cadence recalled that fateful day and broke down.

“I was going for a job interview. I left my daughter in the park because I thought leaving her alone in the tent would be unsafe. I told her to wait there until I came,” Cadence revealed.

“I remember I slipped and fell in the underpass. My head hit the edge of the staircase, and I blacked out. When I woke up, I was in the hospital. I could not remember anything.”

For illustration purposes only | Source: Pixabay

“I’m glad you are safe, my dear. And I’m really happy Meg found you. She missed you so much,” Albert teared up.

Cadence and her daughter lived with Albert until she found a job. A few months later, she dated Frank, a widower with two children, and married him.

Cadence and Meg moved into their new house and were always thankful to Albert for his help. He was happy for them, although he knew he would miss Meg terribly.

Time passed, but Meg and her mother never forgot Albert. They became a part of his family and constantly visited him on the weekends, and every summer, they even vacationed together by the sea.

For illustration purposes only | Source: Pexels

What can we learn from this story?

- Nothing is impossible, so keep going until you accomplish what you want. Despite having little to no leads in tracking down Meg’s mother, Albert never gave up. Ultimately, he reunited the lost little girl with her mother.

- Only light can drive out darkness; Only love can drive out sorrow. Albert was distraught after losing his family in an accident. His life was a dark hollow until he met little Meg in the park.

Tell us what you think, and share this story with your friends. It might inspire them and brighten their day.

Leave a Reply