The question of what is going on behind closed doors at Windsor is one of the most asked questions during the last couple of months, or better said since Kate Middleton‘s last public appearance.

The Princess of Wales had undergone a “planned” abdominal surgery in mid-January and ever since, her exact health state or whereabouts haven’t been discussed by the Palace except for the statement which came as a for of reassurance that she was “doing well,” and that they won’t be sharing any details except when they feel something truly significant takes place.

The people of Britain, as well as those from around the world who closely follow the situation involving Kate and the rumors surrounding her state, were given a glimpse of hope when the Minister of Defense confirmed that she would be attending the Trooping the Colour dress rehearsal ceremony on June 8, ahead of the main event on June 15.

However, it later turned out that it was a mistake and that Kate’s potential return to royal duty event has been deleted from an Army website. As per GB News, Kensington Palace was “not consulted” regarding the Princess of Wales’ appearance.

“It seems the MoD jumped the gun with this announcement and that Kensington Palace was not consulted…we will have to wait to see if the PoW will be well enough to attend,” Telegraph royal reporter Victoria Ward posted on X.

What’s most, the event’s overview mentioned Kate’s presence multiple times.

“Trooping the Colour reviewed by Her Royal Highness The Princess of Wales is identical to Trooping the Colour reviewed by His Majesty The King,” “Trooping the Colour reviewed by Her Royal Highness The Princess of Wales also includes 250 soldiers from the Foot Guards,” and “The soldiers will be inspected by Her Royal Highness The Princess of Wales, Colonel Irish Guards.”

The site removed every information related to Kate and the event as well as her photo on the site’s landing page.

Kate hasn’t been seen in public for a long period of time, which is very unusual for a royal of her rank.

The public could last see her on a photo taken by TMZ, which some claimed was staged.

She also posted a photo herself on Mother’s Day on which she could be seen together with her children, but it was later determined the photo had been edited at parts which led to the news agencies to issue “kill notices,” which are advisory notices to remove or not use a specific photo.

“It appears that the source has manipulated the image,” the Associated Press notification read.

They also released a statement, saying, “The Associated Press initially published the photo, which was issued by Kensington Palace. The AP later retracted the image because at closer inspection, it appears that the source had manipulated the image in a way that did not meet AP’s photo standards. The photo shows an inconsistency in the alignment of Princess Charlotte’s left hand.

Although the Palace didn’t comment on the edited photo, Kate herself decided to explain why the image had “flaws.”

On her and William’s official X account, she wrote, “Like many amateur photographers, I do occasionally experiment with editing. I wanted to express my apologies for any confusion the family photograph we shared yesterday caused. I hope everyone celebrating had a very happy Mother’s Day. C.”

Kensington Palace has later confirmed it “would not be reissuing the original unedited photograph of Kate and her children.”

Please SHARE this article with your family and friends on Facebook.

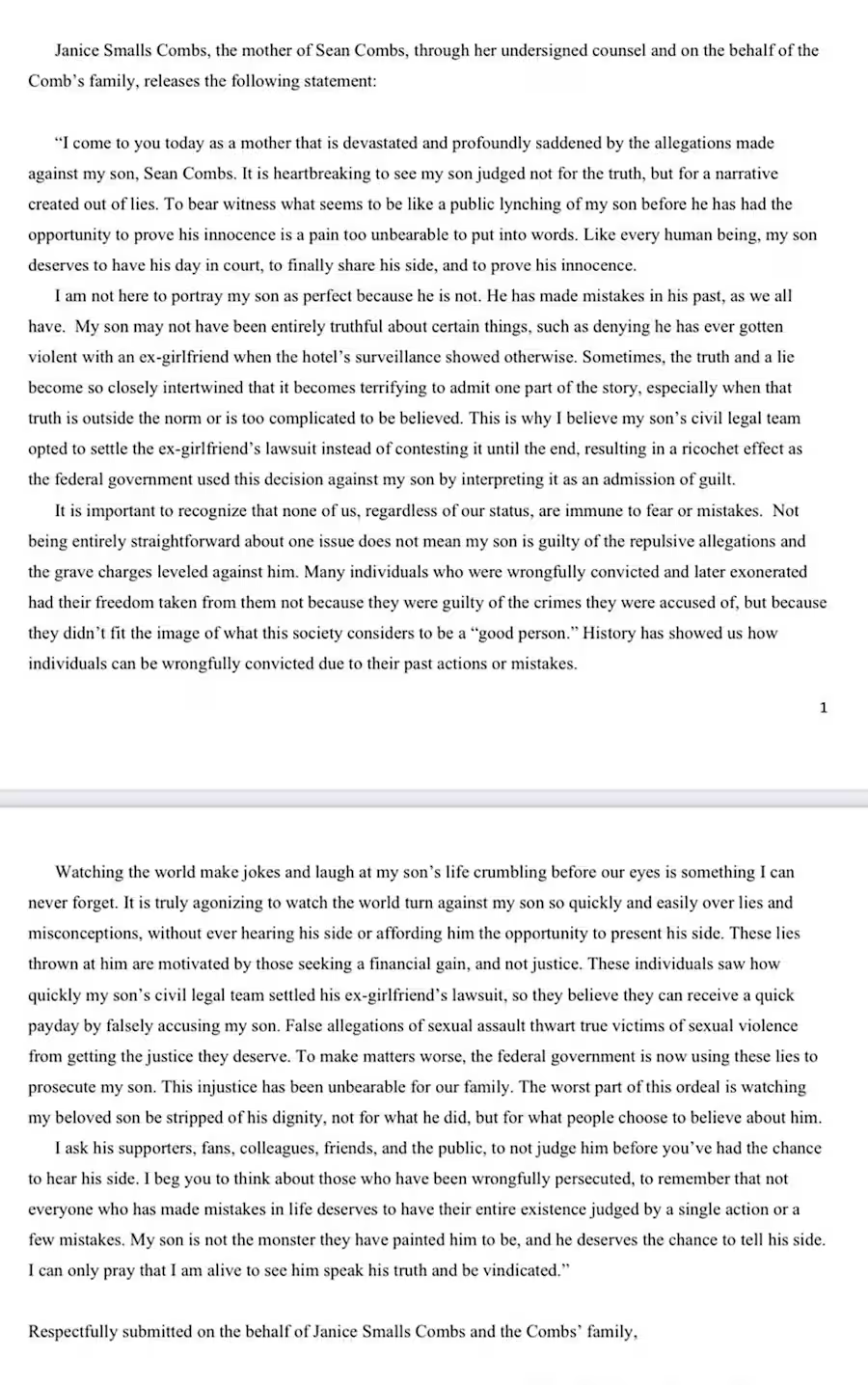

Diddy’s mother shared a statement with Local 10 News.

ARCHIVO – Sean Combs llega a la gala previa a los Grammy y saludo a los conos de la industria en el Hotel Beverly Hilton el sbado 25 de enero de 2020 en Beverly Hills, California. (Foto Mark Von Holden/Invision/AP, archivo) (Mark Von Holden, 2020 Invision)

Diddy’s mother, Janice Smalls Combs, spoke to Local 10 News on Sunday about her son’s recent issues. She acknowledged that her 54-year-old son might have lied about the domestic violence seen in a video but said this doesn’t mean he is guilty of the sexual assault accusations against him.

In a statement shared by Fort Lauderdale attorney Natalie G. Figgers, Diddy’s mother said, “My son is not the monster they have painted him to be.”

Meanwhile, a Houston attorney announced on Tuesday that he is representing 120 people who have accused Diddy of sexual misconduct.

The music executive is also awaiting trial for sex trafficking at the Metropolitan Detention Center in Brooklyn.

Read the complete statement:

Leave a Reply