For most people, their first home isn’t their dream home. It starts off nice enough. But as time goes by and your family grows, starter homes tend to get a little . . . cramped.

But don’t hate on your current home too much. Because while it gave you a safe and dry place to lay your head at night, it was also setting you up to own your dream home someday.

We’ll show you how it all works and walk you through the steps that’ll get you in your dream home—one you can actually afford!

How to Get Your Dream Home in 5 Steps

Here are the steps:

- Follow the Financial Basics

- Find Out How Much Equity You Have

- Set Your New Home-Buying Budget

- Find the Right Dream Home for You

- Be Picky and Patient

Now let’s cover each step in more detail.

Step 1: Follow the Financial Basics

First thing’s first—you have to get out of debt, get on a budget, and build up an emergency fund of 3–6 months of expenses. Sounds pretty basic, right? If you haven’t completed these steps, then you’re not ready to upgrade to your dream home . . . yet.

Now, when you’ve got house fever, it can be hard to focus on paying off debt or saving an emergency fund before you upgrade your home—especially when you’re feeling the pressure of rising home prices and interest rates.

But whether it’s your second or third house, you should only buy a home when you’ve covered the financial basics we mentioned above. Then you’ll be ready to start the journey toward owning your dream house.

And that journey starts with your home equity. What’s equity? Well, we’re glad you asked . . . that brings us to the next step.

Step 2: Find Out How Much Equity You Have

Home equity is a pretty simple concept: It’s your current home’s value minus whatever you still owe on your mortgage.

See, in most cases, your home’s value increases over time. Similar to other long-term investments (like retirement accounts), homes gradually increase in value. There have been periods of ups and downs in the market to be sure, but the value of real estate has consistently gone up. According to the St. Louis Federal Reserve, the average sale price of a home has increased over 2,300% from 1965 to 2023! And in the last ten years (2013 to 2023), there’s been a 68% increase.1 As your home increases in value, so does your equity. In real estate terms, this is called appreciation.

Other factors that increase your home’s equity include:

- Added value: Home improvement projects like adding square footage, updating fixtures and appliances, or even just slapping on a new coat of paint can add value to your home.

- Mortgage paydown: Paying down your mortgage not only gets you out of debt faster, it also builds your equity. The less you owe on your home, the more equity you have.

The amount of equity you have gives you a pretty good idea of how much money you’ll end up with after selling your house. You can use that money to make a hefty down payment and cover the other costs that come with buying a home.![]()

Find expert agents to help you buy your home.

So, how do you determine your home’s value? Well, you can get a ballpark estimate on real estate websites like Zillow, ask a trusted real estate agent to perform a competitive market analysis (which they’ll do anyway if they’re helping you sell your house), or get a professional appraisal.

Finding out your home’s equity will involve a little math, but it’s third-grade-level stuff, so don’t sweat it.

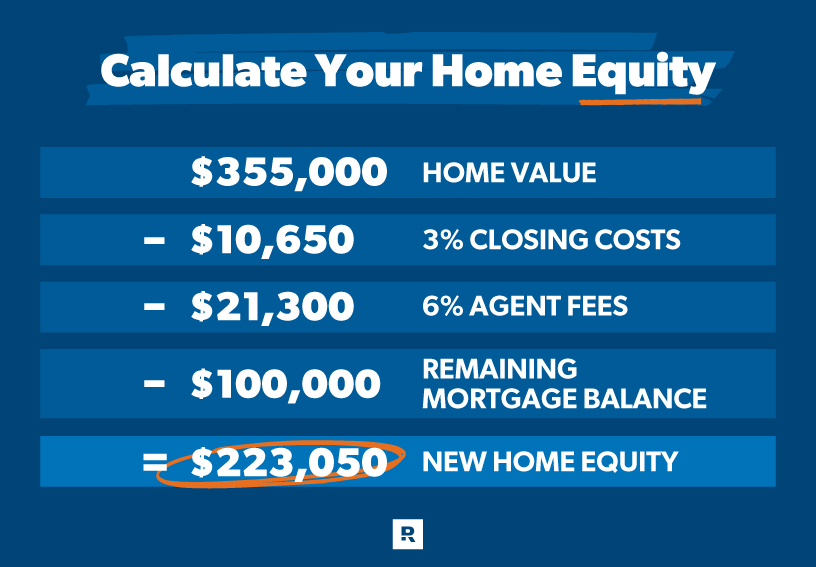

Here’s what we mean. Let’s say your home’s current value is $355,000. When you sell that house, you’ll have to pay for between 1–3% of the sale price in closing costs, another 6% in fees for the real estate agent who helped you sell it, and whatever’s left to pay off on your mortgage.

That means you can estimate clearing over $223,000 from selling your house. That’s a killer down payment on your dream home! And if your home is paid off, that’s even more money to put down and use to pay for things like repairs and moving expenses.

Step 3: Set Your Dream Home Budget

Once you know how much you’ll clear from the sale of your home, you can start making a budget for your dream home.

The key to owning your dream home (instead of it owning you) is to keep your mortgage payment to no more than 25% of your take-home pay on a 15-year fixed-rate mortgage, along with paying a down payment of at least 20% to avoid private mortgage insurance (PMI). Never get a 30-year mortgage even if the bank offers it (and they will). You’d pay a fortune in interest—money that should go toward building your wealth, not the bank’s.

So, let’s say your take-home pay is $4,800 a month. That means your monthly mortgage payment shouldn’t be any bigger than $1,200. By the way, that 25% figure should also include other home fees collected every month with the mortgage payment like homeowners association (HOA) fees, insurance premiums and property taxes.

Plug your numbers into our mortgage calculator to see how much house you can afford.

And don’t forget to budget for all those other costs that come with the home-buying process in addition to your closing fees—things like moving expenses and any upgrades or repairs you might need to make. You don’t want these hidden costs to catch you off guard or drain your emergency fund.

Step 4: Find the Right Dream Home for You

This is where things get real. After all your hard work building up your equity (and doing a lot of math—don’t forget that), you’re finally ready to start the house hunt. Woo-hoo!

But don’t lose focus. Stay zoned in by making a list of features that make a home fit your budget, lifestyle and dreams—and stick to it throughout your house hunt. Here are a few ideas to get you started.

- Don’t compromise on location and layout. If you plan to be in this home for the long haul, an out-of-the-way neighborhood or a wacky floor plan is a deal breaker. Look for a community and layout that’ll suit your lifestyle now and for years to come.

- Think about how much space your family needs. While your budget has the final say about how much home you buy, you’ll want your dream home to fit your family’s needs through different life seasons.

- Consider the school districts. If you have or want kids, the quality of the nearby school districts is probably already on your mind. But even if you don’t have kids or you’re retired, keep in mind that having good schools nearby could increase your home’s value.

- Look for a house that’ll grow in value. Are home values rising in the area? Is the number of businesses going up? These factors can help you figure out whether your dream home will turn into a good investment.

- Count the costs. Want that fancy master bathroom with the multiple showerheads and the Jacuzzi tub? Be clear on what’s a must-have and what’s nice to have. And don’t forget, upgraded features like that will make your dream home more expensive.

Step 5: Be Picky and Patient

We know you’re anxious to get into those new digs, but be patient. Wait for the right house at the right time. Don’t spend your money on a less-than-ideal home just because you’re tired of looking.

The key is finding a good real estate agent who understands your budget and refuses to settle for “good enough.” They’re as committed to your dream as you are and will have your back throughout the entire process, no matter what it takes.

In addition to teaming up with a great real estate agent, you can take a couple of extra steps to make sure you’re ready to strike as soon as the right home comes up:

- Get preapproved for a 15-year fixed-rate mortgage. Having preapproved financing is a green flag for sellers—especially in multiple offer situations. And because this puts most of your information in the lender’s system, you’ll be on the fast track to closing once your offer is accepted.

- Offer earnest money with your bid. Earnest money is a deposit to show you’re truly interested in a home. Usually it’s 1–2% of the home’s purchase price and it’s applied to your down payment or closing costs. Even if the deal falls through, you can almost always get most of it back.

Find a Real Estate Expert in Your Local Market

Now, you might be thinking you have some work to do before you’re ready to find your dream home. Or you may be realizing your years of hard work are about to pay off! Regardless, if you follow these steps, you’ll find the house you’ve always wanted and avoid a purchase you’ll regret.

Once you’re ready, connect with one of our RamseyTrusted real estate agents. These are high-performing agents who do business the Ramsey way and share your values so you can rest easy knowing the search for your dream home is in the right hands.

Find the only real estate agents in your area we trust, and start the hunt for your dream home!

“There’s not one piece that I didn’t go out and buy or that I can’t tell you a story about.”

Millionaires are Jamie Lee Curtis and her spouse Christopher Guest. However, for the past 30 years, the famous couple has made the decision to reside in the same stunning home.

In December 2022, Jamie Lee Curtis and Christopher Guest celebrated their 38th wedding anniversary. Throughout their marriage, they have resided in the same home. Annie and Ruby, their children, grew up in the beautiful house.

Jamie Lee Curtis is a Hollywood royalty, descended from actor Tony Curtis and actress Janet Leigh. She developed a prosperous acting career by following in their footsteps and starring in beloved films like “Halloween” and “Freaky Friday.”

Curtis has received recognition for her exceptional acting abilities throughout her career. She was previously nominated for a Golden Globe for the sitcom “Anything But Love.” She was raised in Los Angeles, first as an adult and subsequently with her parents.

Curtis is one of the few well-known writers who has won over critics and book lovers in addition to her acting profession. She became well-known for writing children’s books when she released “When I Was Little: A Four-Year-Old’s Memoir of Her Youth” in 1993.

Books that her kids inspired

Actor-Filmmaker Christopher Guest is credited by Curtis with inspiring her two children. The basis for her second novel, “Tell Me Again About The Night I Was Born,” which was released in 1996, came from the adoption of their oldest child, Annie.

She co-wrote the New York Times best-selling book “Today I Feel Silly and Other Moods That Make My Day” two years later. She wrote “Is There Really a Human Race?” in 2006, drawing inspiration from Ruby, her adoptive daughter.

HER MATERNITY WITH CHRISTIPH GUEST

Since 1984, Curtis and her spouse have been joined in marriage. She has expressed her gratitude to the man countless times, and she is thrilled to spend the rest of her life with him. On their 36th anniversary of marriage, she wrote:

“My hand is in his.” Both then and now. Our children, families, and friends were the connections in our emotional chain, guiding us through both success and failure.

Curtis previously talked candidly about the instant she realized she would marry Guest. The actress made it real when she saw his photo in a Rolling Stone publication in 1984, right before the premiere of “This Is Spinal Tap.”

The actress claimed that she gestured to a picture of Guest sporting a plaid shirt. She pointed at him and informed her companion that she would marry that man even though she had never seen him before.

Curtis decided to take a chance and called Guest’s agent the very following day. If Guest was interested, she asked him to phone her and gave him his number.

Sadly, he never phoned, and she continued living her life and dating other men. She drove to Hugo’s restaurant in West Hollywood after they broke up. She looked up there and noticed Guest three tables away.

She waved back to Guest when he had finished waving. He raised his hand and gave a shrug as he stood up to go. He phoned her the very next day, and they went on their first date a few days later.

After a few months, Guest took a plane to New York City to record “Saturday Night Live” for a whole year. They were totally enamored with one another at the time, and they haven’t looked back.

The 1920s Spanish Colonial Revival house that Curtis entered in 1992 would end up being her first residence. Regarding the interior design of the home, the actress said, “There’s not one piece that I didn’t go out and buy or that I can’t tell you a story about,” acknowledging that at the time she thought she could make any place beautiful.

For Guest, however, it was not. Curtis revealed that he would frequently display disdain in his facial expressions when house hunting. But he was different for this particular property.

He began examining the eucalyptus trees around the house and its terracotta roof tiles before concluding that they ought to buy it. He would subsequently say that the home’s park-like environment had pleased him.

Despite being built in 1929, the house had not been modified when the previous owners moved in. As a result, they enlisted Jan McFarland Cox’s assistance to revitalize the house, which is now light and spacious.

The house is filled with traces of Curtis’s two children. She combined aspects of a more modern zen design with those of an ancient traditional Mediterranean home.

Curtis and Guest’s belief that fusing old and new is an integral part of who they are is reflected in the home. The home serves as an inspiration for the children’s book author to produce works of art.

The couple worked with architect Michael B. Lehrer and his wife Mia on renovations and landscape design while they were renovating the home before moving in. Before remodeling the master bedroom and bathroom, they started on adding bedrooms for their kids.

After remodeling the basement level, Lehrer opened up the kitchen to create a family area—a location that Curtis refers to as “the emotional center of the house.” She asked Cox to design interiors that highlighted the Mediterranean roots of the home.

Curtis and Guest are positive that they have brought happiness into the house. “I think it’s like anything: it’s a work in progress,” a guest once said. This house will continue to exist.

It’s true that Curtis uses wall art, hanging fabric dividers, and kitchen towels to hang inspirational sayings to keep the home lively. Timeless hardwood furnishings that maintain the Mediterranean aesthetic perfectly complement their home’s light and airy ambiance.

Curtis and Guest created a devoted household, but they also shared a profound understanding of what it meant to be “home” with one another. When I pull up and see that you are home, I feel protected, the actress once wrote a song for her husband.

She feels that the song’s words, despite their simplicity, perfectly capture what it means to be in a long marriage. She values the security that comes from knowing her spouse is home and that she is not by herself.

Now that they are empty nesters, Curtis and Guest take solace in their time spent together. Their daughter Ruby changed from her prior identity as Thomas, and their oldest daughter Annie is now married.

At the age of 25, Ruby, the second of Curtis’s two children with Guest, made the decision to transition. With Ruby teaching her to reject the notion that gender is fixed, Curtis is ecstatic for her children.

Ruby married in 2022 in the same manner that Annie is already married. Curtis was pleased to announce that she presided over her daughter’s wedding.

Leave a Reply